Press Releases

Signing of Tax Convention between Japan and Jamaica

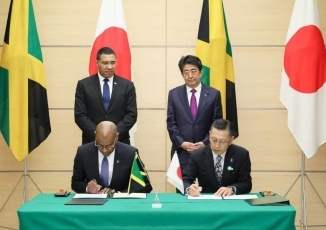

Photograph of the leaders attending the

Photograph of the leaders attending the signing and exchange of documents ceremony

(Photo: Cabinet Public Relations Office)

Photograph of the leaders attending the

Photograph of the leaders attending the signing and exchange of documents ceremony

(Photo: Cabinet Public Relations Office)

1. On December 12, “Convention between Japan and Jamaica for the Elimination of Double Taxation with respect to Taxes on Income and the Prevention of Tax Evasion and Avoidance (hereinafter referred to as the Convention)” (English(PDF) /Japanese(PDF)

/Japanese(PDF) )was signed in Tokyo by H.E. Mr. Hiromasa Yamazaki, Ambassador of Japan in Jamaica and H.E. Mr. Clement Philip Ricardo Allicock, Ambassador of Jamaica to Japan.

)was signed in Tokyo by H.E. Mr. Hiromasa Yamazaki, Ambassador of Japan in Jamaica and H.E. Mr. Clement Philip Ricardo Allicock, Ambassador of Jamaica to Japan.

2. For the purpose of eliminating double taxation arising between the two countries, this Convention clarifies the scope of taxable income in the two countries. In addition, this Convention will enable the tax authorities of the two countries to consult each other on taxation not in accordance with the provisions of this Convention, to exchange information concerning tax matters and to mutually lend assistance in the collection of tax claims. It is expected that, while eliminating double taxation and preventing international tax evasion and tax avoidance, this Convention promotes further mutual investments and economic exchanges between the two countries.

3. The following are the key points of the Convention.

(1) Taxation on Business Profits

Where an enterprise of one of the two countries has in the other country a permanent establishment (such as a branch, including the furnishing of services by an enterprise through personnel over a certain period of time) through which the enterprise carries on business, only the profits attributable to the permanent establishment may be taxed in that other country.

(2)Taxation on Investment Income

Taxation on investment income (dividends, interest and royalties) in the source country will be subjected to the maximum rates or exempted as follows:

Dividends 5% (holding at least 20% of shares* for 365 days)

10% (others)

Interest Exempted (received by the Governments, etc.)

10% (others)

Royalties 2% (Equipment)

10% (Others)

voting power (where paid by a company of Japan), or capital or voting power (where paid by a company of Jamaica)

(3) Prevention of Abuse of the Convention

In order to prevent abuse of benefits under this Convention, any benefit under this Convention will not be granted if it is reasonable to conclude that obtaining such a benefit was one of the principal purposes of any transaction, or if the income is attributable to a permanent establishment in a third country and does not satisfy specified conditions.

(4) Mutual Agreement Procedure and Arbitration Proceedings

Taxation not in accordance with the provisions of this Convention may be resolved by mutual agreement between the tax authorities of the two countries. In addition, where such taxation has not been resolved through the consultation between the tax authorities of the two countries within two years, the unresolved issue will be resolved pursuant to a decision of an arbitration panel composed of third parties.

(5) Exchange of Information and Assistance in Collection of Tax Claims

In order to effectively prevent international tax evasion and tax avoidance, the exchange of information concerning tax matters and the mutual assistance in the collection of tax claims between the two countries are introduced.

4. After the completion of the necessary domestic procedures in each of the two countries (in the case of Japan, approval by the Diet is necessary), each of the two countries shall send through diplomatic channels to the other country the notification confirming the completion of its internal procedures. This Convention will enter into force on the thirtieth day after the date of receipt of the latter notification and will have effect:

(a) in Japan:

(i) with respect to taxes levied on the basis of a taxable year, for taxes for any taxable years beginning on or after 1 January in the calendar year next following that in which this Convention enters into force; and

(ii) with respect to taxes levied not on the basis of a taxable year, for taxes levied on or after 1 January in the calendar year next following that in which this Convention enters into force; and

(b) in Jamaica:

(i) with respect to taxes withheld at source, for income paid or credited on or after 1 January in the calendar year next following that in which this Convention enters into force; and

(ii) with respect to other taxes, for any taxable year beginning on or after 1 January in the calendar year next following that in which this Convention enters into force; and

(c) The provisions concerning the exchange of information and the assistance in the collection of taxes have effect from the date of entry into force of this Convention without regard to the date on which the taxes are levied or the taxable year to which the taxes relate.