Part V Promotion of Effective and Strategic Development Cooperation

A Japan Overseas Cooperation Volunteer (JOCV) teaching Judo to children in Tunisia with a colleague at the Tunisian Judo Federation Kalaat Andalous branch (Photo: Ahmed Souayed/JICA)

1 Solidarity with Various Partners to Realize Co-Creation

The new Development Cooperation Charter sets forth “co-creation” as the basic policy of ODA whereby various actors, such as the private sector and public financial institutions, bring their respective strengths in relation to various development challenges without established solutions, and engage in dialogue and collaboration to create new social values.

(1) Partnership with Private Sector

The Government of Japan strives to effectively leverage the collective strengths of the Japanese private sector in ODA projects implemented by the Ministry of Foreign Affairs (MOFA) and JICA through effective mobilization of their advanced technologies, knowledge, experiences, and financial resources. The government also promotes and strengthens partnerships with the private sector in investment projects, with the intention of implementing effective, efficient projects and enhancing development outcomes, through incorporating private-sector knowledge and expertise when formulating ODA projects, and assigning different roles to the public and private actors, with ODA covering basic infrastructure development and the private sector undertaking investment, operation, and maintenance, for instance.

A. Proposal-Based Public-Private Partnership Support Facilities

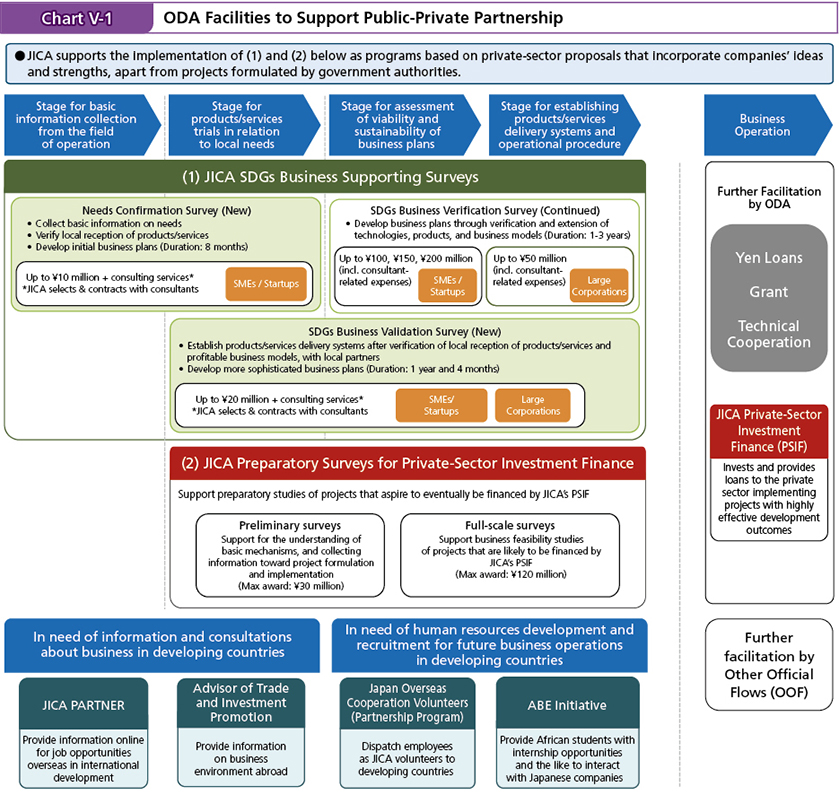

In order to proactively solicit views and incorporate proposals from the Japanese private sector in ODA projects, the Government of Japan and JICA facilitate support for private sector proposals for public-private partnerships, such as “SDGs Business Supporting Surveys” and “Preparatory Surveys for Private-Sector Investment Finance.”

■ SDGs Business Supporting Surveys

Experiment of drone transportation of blood products in Mongolia (Aeronext Inc./SDGs Business Supporting Surveys)

SDGs Business Supporting SurveysGlossary is a program that promotes collaboration with a variety of partners with the aim to incorporate uninhibited ideas from the private sector in development cooperation, and to provide solutions to local development challenges with a business mindset by tapping into private-sector products and technologies. JICA calls for submissions on its website, and screens the proposals of companies based on their project plans.

The cumulative number of projects adopted under the SDGs Business Supporting Survey between 2010 and 2023 amounted to 1,516. In FY2023, a total of 68 projects in 29 countries were adopted; 32 projects for the Needs Confirmation Survey, 23 projects for the SDGs Business Verification Survey with the Private Sector, 12 projects for the “SME Support Type,” and 1 project for the “SDGs Business Support Type” (see also “Master Techniques from Japan to the World 1” and “Master Techniques from Japan to the World 4.” For more information about the program’s framework, project fields and countries, and other details, see JICA’s websiteNote 1).

■ Preparatory Surveys for Private-Sector Investment Finance

Recent years have seen a growing trend of infrastructure development through public-private partnerships in developing countries and of economic and social development through private-sector projects. JICA implements its Preparatory Surveys for Private-Sector Investment Finance (PSIF) to formulate projects that utilize private-sector funds on the premise that public support is provided. JICA supports feasibility studies for the formulation of business plans and calls for proposals widely from the private sector that explore the possibility of participating in projects in developing countries (for more information about the program’s framework, target areas and countries, and other details, see the JICA website).Note 2 The total number of projects adopted from 2010 to FY2022 has reached 86, and in 2023, one project was adopted in Asia.

■ JICA Private-Sector Partnership Volunteer Program

Under the “JICA Private-Sector Partnership Volunteer Program,” established in 2012, 129 volunteers have been dispatched to 38 countries by March 2023 and JICA has actively supported the overseas expansion of companies through this program. Through their activities, volunteers are expected to learn unique business practices and identify the market needs in the countries of their assignment, and then to apply such understanding to their business activities in Japan upon their return. In April 2023, together with other facilities for the university partnership volunteer program and the local government partnership volunteer program, this program was integrated into the “Japan Overseas Cooperation Volunteers (Partnership Program)” (see also “Featured Project”).

B. Private-Sector Investment Finance

Private-Sector Investment Finance (PSIF)Glossary refers to a type of ODA financing scheme in which JICA provides investments and loans to the private sector carrying out projects in developing countries that are considered highly effective from a development perspective but not able to attract sufficient funding from private financial institutions. As JICA signed a total of 114 investment and loan contracts from 2011 to the end of FY2022, many Japanese companies are engaged (for more information about the program’s framework, target areas, conditions, and other details, see the JICA website).Note 3 Recent examples of successful PSIF projects include a wind power project in Laos (loan project) and a project designed to support start-up companies in Africa (investment in funds), both of which were signed in 2023. The former is the first wind power generation project in Laos, and the power will be sold cross-border to Vietnam Electricity (EVN), contributing to strengthening the connectivity in the Mekong region. This project will help increase the power supply from renewable energy sources in Laos, where a wind farm will be constructed, while addressing climate change through the reduction of greenhouse gas emissions in Viet Nam. The latter aims to help boost sustainable economic growth in Africa through investments in venture capital funds for start-up companies that create innovative solutions to social challenges in areas such as financial inclusion, healthcare, and climate change. While Japan has supported entrepreneurs in Africa through “Project NINJA (Next Innovation with Japan)”Note 4 and other programs, this project will expand the scope of Japan’s support to include financial assistance for early-stage start-ups. Furthermore, it is expected to enhance the collaboration between Japanese companies and start-ups in Africa.

At the side-event on the Partnership for Global Infrastructure and Investment (PGII) held during the G7 Hiroshima Summit on May 20, 2023, Prime Minister Kishida made a commitment that Japan will contribute to sustainable development in partner countries through public and private infrastructure investment. Based on this commitment, Japan established financing facilities in three areas – climate change actions, food security, and financial inclusion (see Part I, Section 2 for details).

Japan’s development cooperation takes place in partnership with diverse actors. In implementing development cooperation, it is important for the government to strengthen collaboration between JICA and other agencies responsible for handling other official flows (OOF) such as Japan Bank for International Cooperation (JBIC),Glossary Nippon Export and Investment Insurance (NEXI), the Japan Overseas Infrastructure Investment Corporation for Transport and Urban Development (JOIN), the Fund Corporation for the Overseas Development of Japan’s ICT and Postal Services (JICT), and the Japan Organization for Metals and Energy Security (JOGMEC) and to serve as a catalyst for mobilizing and assembling a wide range of resources, including private sector ones.

In addition, utilizing the organizations’ extensive experience and expertise in developing countries, international organizations, such as the United Nations Development Programme (UNDP) and the United Nations Children’s Fund (UNICEF), assist Japanese companies in practicing inclusive businesses.Glossary

C. Grant for Supporting Business and Management Rights

Since FY2014, the Government of Japan has made available Grants for Supporting Business and Management Rights, with which Japanese companies are engaged at all stages of public works projects in developing countries, from facility development to operation, maintenance, and management of those facilities. This grant is designed to support Japanese companies in leveraging their technologies and know-how in the socio-economic development efforts of developing countries through the acquisition of business and management rights in such public-private partnership projects.

Glossary

- SDGs Business Supporting Surveys

- The program builds on proposals from the private sector to assist in matching the needs of developing countries with the advanced products and technologies, etc., possessed by the Japanese private sector, and facilitates the development of businesses that help solve problems in these countries. The program is expected to not only support Japanese small and medium-sized enterprises (SMEs) in expanding their businesses abroad, but also stimulate the domestic economy and local communities in Japan (see also Chart V-1).

- Private-Sector Investment Finance (PSIF)

- A type of ODA financing scheme implemented by JICA that provides the private sector carrying out projects in developing countries with necessary financing in the form of investments and loans. Although projects in developing countries create jobs and revitalize the economy of hosting countries, they entail various risks, and high returns cannot often be expected. Thus, private financial institutions are often reluctant to provide these companies with sufficient financing. PSIF provides investments and loans to projects in developing countries in a way to support their development. PSIF assists in the fields of (1) infrastructure development and growth acceleration and (2) SDGs including poverty reduction and climate change actions.

- Japan Bank for International Cooperation (JBIC)

- A policy-based financial institution wholly owned by the Japanese government. While its primary purpose is to supplement the services of general financial institutions, its goal is to contribute to the sound development of Japan and the international economy and society. To this end, JBIC operates in the fields of (1) promoting the overseas development and securement of resources that are important for Japan, (2) maintaining and improving the international competitiveness of Japanese industries, (3) promoting overseas businesses that also work to preserve the global environment, such as preventing global warming, and (4) preventing disruptions to international financial order or taking appropriate measures with respect to damages caused by such disruptions.

- Inclusive business

- Inclusive business is a generic term for business models advocated by the UN and the World Bank Group as an effective way to achieve inclusive market growth and development. It includes sustainable Base of the Economic Pyramid (BOP) businesses (businesses expected to help solve social issues through the engagement of low-income groups (Base of the Economic Pyramid) in developing countries and regions).

- Note 1: About SDGs Business Supporting Surveys https://www.jica.go.jp/priv_partner/activities/sme/index.html (in Japanese only)

- Note 2: Preparatory Surveys for Private-Sector Investment Finance https://www.jica.go.jp/priv_partner/activities/psiffs/index.html (in Japanese only)

- Note 3: Private-Sector Investment Finance https://www.jica.go.jp/activities/schemes/finance_co/loan/index.html (in Japanese only)

- Note 4: See Note 23.