Foreign Missions in Japan

Exemption of the Consumption Tax for the Diplomatic Missions in Japan

When foreign missions in Japan, and their members such as ambassadors and other diplomats stationed in Japan (hereinafter referred to as the "Missions”) purchase goods or receive services at stores designated by the Commissioner of the National Tax Agency (hereinafter referred to as the “Designated Stores”), they may qualify for exemption from the consumption tax under certain conditions.

Please be aware that the Missions can purchase goods or receive services at tax-exempt prices only at the Designated Stores.

[Note] The range and conditions of tax exemption for goods and services vary depending on the foreign missions.

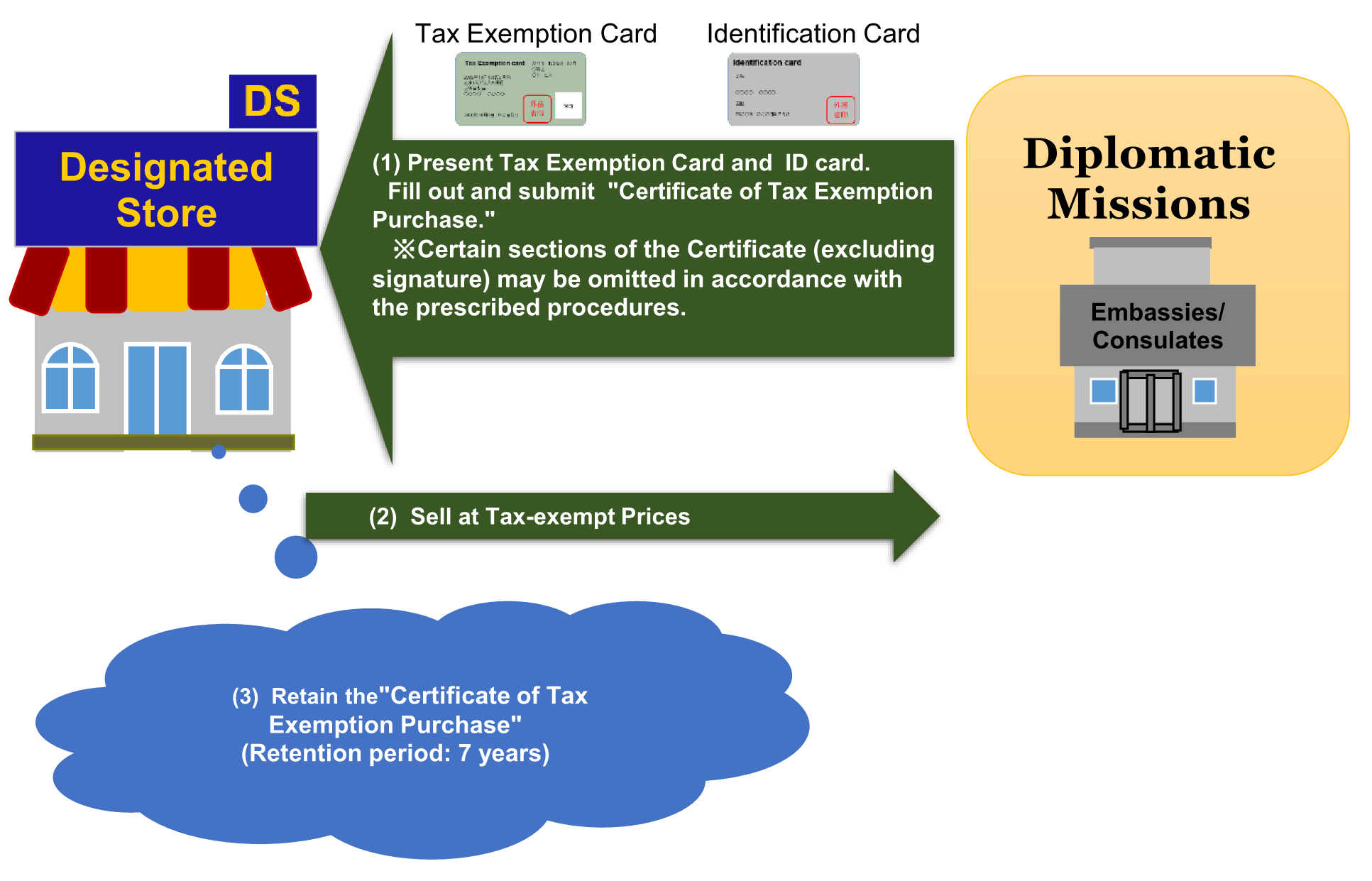

Procedures of Tax Exemption at the “Designated Stores”:

- 1. The Missions are required to:

- (1) Present “Tax Exemption Card” issued by the Ministry of Foreign Affairs

- (2) Present “Identification Card” issued by the Ministry of Foreign Affairs

- (3) Fill out the form, “Certificate of Tax Exemption Purchase for Foreign Establishments (hereinafter referred to as the "Certificate of Tax Exemption Purchase")” and submit it to the stores.

is available for download on the National Tax Agency’s website.

is available for download on the National Tax Agency’s website.

[Note] The Designated Stores may omit filling out relevant information on the Certificate of Tax Exemption Purchase by attaching and keeping a copy of the receipt (which must include the date of purchase, names of goods/services, quantity, total amount, and the name and address of the seller) and a copy of the Tax Exemption Card. The signature on the Certificate of Tax Exemption Purchase, however, cannot be omitted due to the necessity for identity verification. - 2. The Designated Stores sell goods at tax-exempt prices to the Missions.

- 3. Designated Stores should keep the signed original forms of the Certificate of Tax Exemption Purchase for seven years.

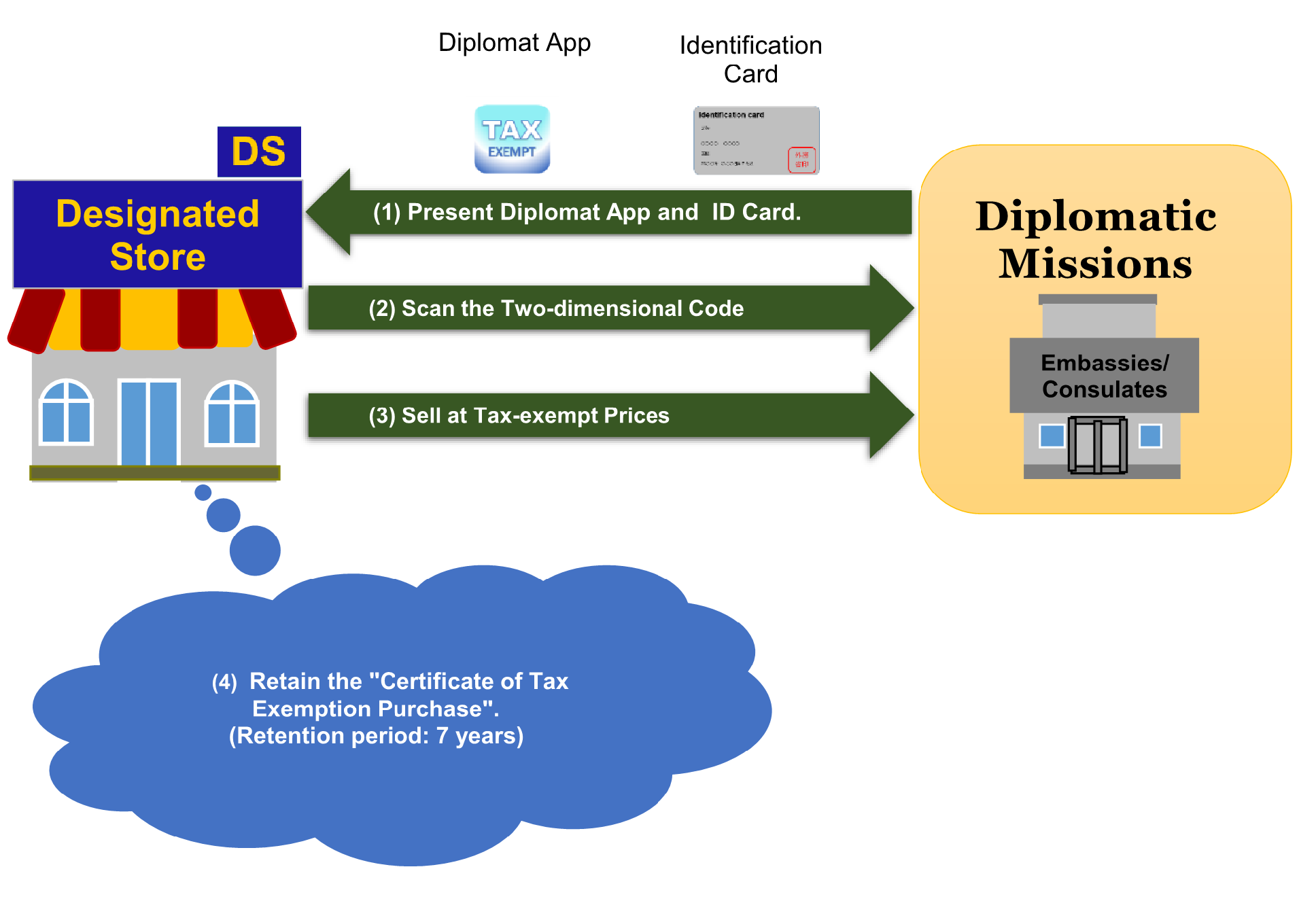

In connection with the partial amendment to the Act on Special Measures Concerning Taxation and its relevant Order effective in April 2024, the Designated Stores are now be able to use a digital system for procedures when selling taxable goods or services to the Missions at tax-exempt prices (the existing document-based method will still be available).

The Ministry of Foreign Affairs is currently developing the following system to accommodate this digital purchase system.

Tax-Exempt App for Diplomatic Missions

1. About Tax Exempt App

This application is necessary for members of diplomatic missions, consular posts and international organizations who have a Tax Exemption Card issued by the Ministry of Foreign Affairs when they use the digital system to make tax-exempt purchases at designated stores.

2. What this app can do

- (1) By presenting the Tax Exemption Card information displayed on the smartphone registered in the application to the store, tax-exempt purchase procedures are completed in the same way as with a conventional Tax Exemption Card. (The ID card must still be presented separately).

- (2) The designated stores can be easily found by using the search function.

3. Privacy Policy

Name of Provider

Diplomatic Missions Division

Minister's Secretariat

Ministry of Foreign Affairs

2-2-1 Kasumigaseki, Chiyoda-ku, Tokyo 100-8919, Japan

Collection of User Information

This application does not collect any user information; if the GPS function is enabled, it will be used only within the smartphone application, but it will not access any user information stored on the smartphone.

Privacy Policy Updates

Any updates to the privacy policy of this application will be notified on the installation screen, in the app description of the application, and on the web page. The description in the application will be automatically updated upon launch.

Accessible URL links (in Japanese only, except for the form):

- Detailed procedures for stores and owners wishing to be “Designated Stores” (Japanese)

- Pamphlet by National Tax Agency “Exemption from consumption tax dealing with Diplomatic Missions in Japan” (Japanese) (PDF)

- “Tax Exemption Card” (sample) (PDF)

- Form : “Certificate of Tax Exemption Purchase for Foreign Establishments” (PDF)

- Icon of “Designated Store” (PDF)

For further information:

Diplomatic Missions Division, Minister's Secretariat,

Ministry of Foreign Affairs

TEL: 03-5501 - 8000 (ext. 2958)