Part IV Strengthening Partnership with Diverse Actors and Disseminating Information on Development Cooperation

A Japan Overseas Cooperation Volunteer (JOCV) conducting a seminar for kindergarten teachers in Cameroon to enhance social and emotional education (Photo: JICA)

In order to implement Japan’s development cooperation, besides ODA and other support provided by the Government and JICA, diverse actors such as large companies, small and medium-sized enterprises, local governments, universities, civil society including NGOs, and international organizations need to work together, leveraging their respective strengths. The Government of Japan is utilizing ODA to support the overseas business expansion of Japanese companies so that they can contribute globally. Furthermore, Japan is assisting diverse actors in performing their roles in the field of development cooperation worldwide, as well as mobilizing the power of NGOs and civil society.

At the same time, the Government of Japan will continue to strive to ensure that Japan’s development cooperation is appropriate so that the country’s ODA is implemented efficiently and in a lean way, and to make efforts to strengthen public relations and information dissemination in order to foster a further understanding of Japan’s development cooperation domestically and internationally.

In addition, international organizations, such as the United Nation Development Programme (UNDP) and the United Nations Children's Fund (UNICEF), also promote inclusive businesses* by Japanese companies, utilizing the organizations’ extensive experience and expertise in developing countries.

1. Efforts for Strengthening Partnerships with Diverse Actors

(1) Partnership with Private Companies

In the area of development cooperation, applying private companies’ advanced technologies, know-how, and ideas is expected to provide better support. The Government of Japan will strive to utilize Japan’s excellent technologies and know-how in its grant aid, ODA loan, and other ODA projects, so that the collective strengths of Japanese companies can be further demonstrated in ODA projects by the Ministry of Foreign Affairs (MOFA) and JICA. In addition, Japan will aim to achieve development outcomes by sharing roles between the public and private sectors, promoting partnerships with private sector investment projects, and utilizing private sector technology, knowledge, experience, and funds to carry out projects more efficiently and effectively. For example, private sector knowledge and know-how can be incorporated from the stage of ODA project formation, or basic infrastructure can be covered by ODA while investments, operation, maintenance, and management are carried out by the private sector.

A. Grant Aid

The Government of Japan provides grant aid (including provision of equipment using small and medium-sized enterprises’ (SMEs’) products) to support the overseas expansion of Japanese SMEs and other entities by providing their products to developing countries based on the requests and development needs of developing country governments. This framework not only supports the socio-economic development of developing countries, but also raises the profile of the SMEs’ products provided, thereby creating sustained demand for them.

Furthermore, the Government of Japan has introduced grant aid for business/management rights since FY2014. This grant aid aims to facilitate the acquisition of business and management rights by Japanese companies and utilize Japan’s advanced technologies and know-how for the development of developing countries by providing grant aid to public work projects that comprehensively carry out a continuum of activities from facility construction to operation, maintenance, and management with the participation of private sector. In FY2019, Japan signed an Exchange of Notes for a grant aid under this scheme to expand water supply facilities in Cambodia.

B. Improving Japan’s ODA loans

Up until now, the Government of Japan has introduced the Special Terms for Economic Partnership (STEP) scheme to promote “Visible Japanese Development Cooperation” through the utilization and transfer of Japan’s advanced technologies and know-how to developing countries, and has subsequently taken actions such as improving the aid scheme by expanding the scope of application and lowering interest rates. The Government of Japan has also taken additional measures, such as the establishment of the Stand-by Emergency Credit for Urgent Recovery (SECURE) Note 1. Furthermore, it has also introduced the Equity Back Finance (EBF) loan Note 2 and the Viability Gap Funding (VGF) loan Note 3. These instruments are designed to promote the steady formulation and implementation of infrastructure development projects utilizing Public-Private Partnership (PPP) and to support the recipient governments in the improvement and application of various measures depending on their needs.

In addition, as follow-up measures for “Partnerships for Quality Infrastructure,”* the Government of Japan has been making efforts to improve its ODA loan and Private Sector Investment Finance (PSIF) by speeding up Japan’s ODA loan procedures and creating new ODA loan options. For example, it has reduced the period necessary for Government-related procedures for Japan’s ODA loans that normally require three years to approximately one and a half years for important projects. It has also introduced ODA loans with currency conversion option to middle- to upper-middle-income countries on the condition that JICA’s financial grounds are ensured, and established dollar-denominated ODA loans and Japan’s ODA loans with Preferential Terms for High Specification Note 4. Furthermore, in the “Expanded Partnership for Quality Infrastructure,”* Japan announced that it would further accelerate ODA loan procedures, decided to reduce the period between the initiation of the feasibility study (F/S)* and commencement of the construction work to one and a half years at the fastest, and increased “the visibility” of the project period. Japan will strive to improve the ODA loan so that projects can be formulated and developed in an expeditious manner.

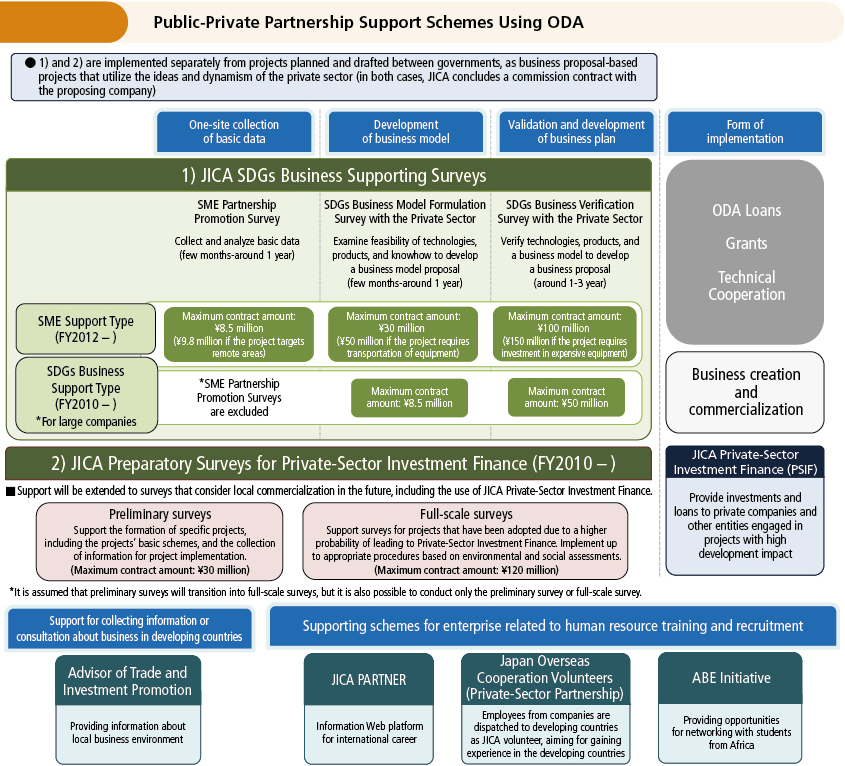

C. Proposal-based Public-Private Partnership Support Schemes

In order to actively utilize opinions and proposals from private companies, the Government of Japan and JICA are also promoting public-private partnership support schemes based on private sector proposals, such as SDGs Business Supporting Surveys and Preparatory Surveys for Private-Sector Investment Finance.

■ SDGs Business Supporting Surveys

Picture book author Ms. SHINJU Mariko (author of the best-selling picture book Mottainai Grandma, which teaches the spirit of “mottainai”: recognizing the value of things and not wasting them) showing children how she creates illustrations at a book fair in Delhi, India / SDGs Business Supporting Survey for the Project for Contributing to Environment and Sanitation Improvement by Reading Japanese Picture Books

SDGs Business Supporting Surveys is a program that aims to solve problems in the field through business and to promote collaboration with a wide range of partners by incorporating ideas from private companies based on their creativity and originality.

The program, which is based on proposals from private companies, assists in matching the needs of developing countries with the advanced products and technologies, etc., possessed by private-sector companies, and supports the development of businesses that contribute to solving problems in these countries. It is implemented as commissioned surveys, and is utilized for necessary information collection and business model development (Small and Medium-sized Enterprise (SME) Partnership Promotion Survey, and SDGs Business Model Formulation Survey with the Private Sector) and for the development of business plans based on the verification activities of proposed products or technologies (SDGs Business Verification Survey with the Private Sector). The program has two categories: SME Support Type and SDGs Business Support Type. The former not only supports the expansion of SMEs’ businesses abroad, but is also expected to invigorate the Japanese economy and local communities.

In FY2019, a total of 173 projects were adopted in 47 countries under this program (See also “Master Techniques from Japan to the World 1” and Master Techniques from Japan to the World 3. For more information about the program’s framework, target areas and countries, and other details, see the JICA website Note 5.)

■ Preparatory Surveys for Private-Sector Investment Finance

In recent years, there has been a growing trend to improve infrastructure through public-private partnership aiming at further enhancing effectiveness and efficiency not only in the construction phase, but also in post-construction operation and maintenance in emerging and developing countries. For such infrastructure projects, it is important for public and private sectors to collaborate and engage with each other from the initial stages of project formulation in order to appropriately divide roles between the public and private sectors. In addition to infrastructure, there has also been a growing trend to promote economic and social development in developing countries through private sector projects. For this reason, as part of its Preparatory Survey proposal-based program, JICA supports feasibility surveys (F/S) for the formulation of business plans by calling for proposals widely from private companies that are planning to participate in projects in developing countries and aiming to utilize Private-Sector Investment Finance (PSIF) (for more information about the program’s framework, target areas and countries, and other details, see the JICA website) Note 6. In FY2019, seven projects were adopted in Asia and Africa.

■ Japan Overseas Cooperation Volunteers (Private-Sector Partnership)

In addition, in order to assist in developing the global human resources required by Japanese SMEs, the Government of Japan established the Japan Overseas Cooperation Volunteers (Private-Sector Partnership)* in 2012. Employees from companies are dispatched to developing countries as Japan Overseas Cooperation Volunteers (JOCVs) under the scheme while keeping their affiliation with their companies. Japan proactively supports overseas expansion of Japanese companies through the scheme.

D. Private-Sector Investment Finance (PSIF)

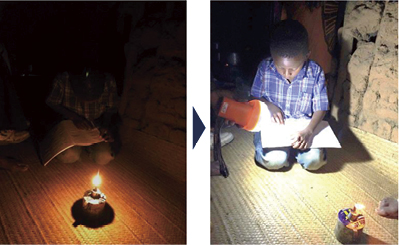

A child studying before and after a kerosene lamp has been replaced with a solar-powered LED lantern. Through the “Off-Grid Solar Power Project in Sub-Saharan Africa,” which was the first PSIF project in Sub-Saharan Africa after the Preparatory Survey for BOP Business Promotion (currently the SDGs Business Supporting Survey), JICA helped to improve access to power for people living in off-grid areas of Tanzania by financing a project by Digital Grid Corporation (Photo: JICA)

The financial needs for the development of developing countries has increased with the globalization of the economy, and the inflow of private finance into developing countries currently exceeds the global total amount of ODA. In light of the growing role of private sector finance in development cooperation, it is becoming increasingly important to promote partnerships utilizing private finance (see also “ODA Topics”).

PSIF refers to a type of ODA financing scheme implemented by JICA, and is provided to private companies carrying out projects in developing countries as investments and loans for their necessary funds. Although such projects create jobs and revitalize the economy of hosting countries, they entail various risks and high return cannot often be expected. Thus, existing financial institutions are often reluctant to provide these companies with sufficient loans. PSIF provides investments and loans for projects that are considered highly effective from a development perspective, but may be difficult to be sufficiently funded by existing financial institutions only. PSIF assists in the following fields for funding: (i) infrastructure development and accelerating growth, (ii) SDGs and poverty reduction, and (iii) measures against climate change. JICA has signed 36 investment and loan contracts in total by the end of FY2019 (for more information about the program’s framework, target areas, conditions, and other details, see the JICA website) Note 7.

Also, in order to reduce the exchange rate risk of Japanese companies participating in infrastructure projects overseas, the Government of Japan announced in succession the introduction of local currency-denominated PSIF (2014) and U.S. dollar-denominated PSIF (2015) to supplement the existing yen-denominated PSIF. In 2015, it announced the acceleration of PSIF, expansion of the targets of PSIF, and strengthening collaboration between JICA and other organizations as follow-up measures for the “Partnership for Quality Infrastructure.” Specifically, initiatives were set out that JICA would start its appraisal process, in principle, within one month after an application is filed by private companies or others. These measures also enabled JICA to co-finance with private financial institutions. Other measures include reviewing the interpretation of the “no-precedent policy” requirement and allowing loans to be provided in cases where non-concessional loans by existing Japanese private financial institutions are impossible, even if loans were provided for similar projects in the past.

In 2016, the Government of Japan decided to examine the possibility of more flexible operation of JICA’s PSIF by relaxing the upper limit of investment ratio from 25% to 50% (but less than the percentage that would make JICA the largest shareholder) and by introducing PSIF in euros in the “Expanded Partnership for Quality Infrastructure.” Subsequent studies concluded that these are operable and can be introduced.

In November 2020, in order to respond promptly with transparency and predictability to the needs of companies applying to carry out projects, the Government of Japan reviewed the operation of the PSIF appraisal process and revised the “Guidelines for Selecting JICA Private-Sector Investment Finance Projects” for the first time.

Japan’s development cooperation is carried out in partnership with diverse actors. When implementing development cooperation, it is important for the Government to strengthen collaboration between JICA and other agencies responsible for handling official funds such as Japan Bank for International Cooperation (JBIC), Nippon Export and Investment Insurance (NEXI), the Japan Overseas Infrastructure Investment Corporation for Transport and Urban Development (JOIN), and the Fund Corporation for the Overseas Development of Japan’s ICT and Postal Services (JICT) as well as to serve as a catalyst for mobilizing and assembling a wide range of resources, including the private sector.

Glossary

- *Inclusive business

- Inclusive business is a generic term for a business model advocated by the UN and the World Bank Group as an effective way to achieve inclusive market growth and development. It includes sustainable Base of the Economic Pyramid (BOP) businesses that resolve social challenges.

- *Expanded Partnership for Quality Infrastructure

- The Expanded Partnerships for Quality Infrastructure was announced by then Prime Minister Abe at the G7 Ise-Shima Summit held in May 2016. It includes Japan’s commitment to provide approximately USD 200 billion funds in the following five years for infrastructure projects in the world including Asia. At the same time, it includes further system reforms, strengthening the structure of related institutions including JICA, as well as securing financial foundation.

- *Partnership for Quality Infrastructure

- Announced by the then Prime Minister Abe in May 2015, the Partnership for Quality Infrastructure has the following pillars: (i) expansion and acceleration of assistance through the full mobilization of Japan’s economic cooperation tools, (ii) collaboration between Japan and ADB, (iii) expansion of the supply of funding for projects with relatively high risk profiles by such means as enhancement of the function of JBIC, and (iv) promoting “Quality Infrastructure Investment” as an international standard.

- *Feasibility survey (Feasibility study)

- Feasibility survey verifies whether a proposed project is viable for execution (realization), and plans and formulates a project that is most appropriate for implementation. The survey also investigates a project’s potential, its appropriateness, and investment effects.

- *Japan Overseas Cooperation Volunteers (Private-Sector Partnership)

- Under the program (formerly known as the Private-Sector Partnership Volunteers), employees of private companies and other entities are dispatched to developing countries as JOCVs, which contributes to fostering global human resources and overseas business expansion of companies. Dispatch destinations, categories, and periods of dispatch are determined through consultation based on the requests from companies. Employees are dispatched to countries and regions in which their companies are considering business expansion. It is expected that the employees will gain language skills, understand the culture, the commercial practices, the technical level, and other matters of the respective destination countries, and acquire communication skills, problem solving, and negotiation abilities through their activities. It is anticipated that these acquired abilities will be brought back into corporate activities upon their return (for details about the scheme and its results, see Chapter 2.11 of Development Cooperation Reference Materials 2019 published on the MOFA website (in Japanese only)).

- Note 1: The system allows developing countries that have a high chance of encountering natural disasters to quickly accommodate funds for post-disaster recovery activities, by having the ODA loan signed in advance.

- Note 2: EBF (Equity Back Finance) loan provides a yen loan to the developing country’s part of the investment of the Special Purpose Company (SPC), which takes the lead in public projects in the developing country. It is restricted to PPP infrastructure projects, wherein the recipient country governments or their nationally-owned companies and others make the investment, and the Japanese companies participate as a business operating body.

- Note 3: Viability Gap Funding (VGF) loan is the loan against VGF which the developing country provides to the SPC in order to secure profitability expected by SPC when Japanese companies invest in the PPP infrastructure projects by the developing country in principle.

- Note 4: Concessional loans provided to projects recognized as contributing to the promotion of “Quality Infrastructure” based on the “G7 Ise-Shima Principles for Promoting Quality Infrastructure Investment” compiled at the G7 Ise-Shima Summit in May 2016.

- Note 5: SDGs Business Supporting Surveys: https://www.jica.go.jp/priv_partner/activities/sme/index.html (in Japanese only)

- Note 6: Preparatory Survey for Private-Sector Investment Finance (formerly Preparatory Survey for PPP Infrastructure Project):

https://www.jica.go.jp/priv_partner/activities/psiffs/index.html (in Japanese only) - Note 7: Overview of PSIF: https://www.jica.go.jp/activities/schemes/finance_co/loan/index.html (in Japanese only)