Japan's Official Development Assistance White Paper 2006

Column I-3 Nobel Peace Prize Awarded to Professor Muhammad Yunus and Grameen Bank

The Nobel Peace Prize for 2006 has been awarded to Professor Muhammad Yunus and the Grameen Bank of Bangladesh, where he is the founder and the Managing Director. It is a financial institution that extends small loans (known as microfinance) to mainly poor landless people for their independent living. It was established in 1983 as a specialized bank with its stock largely owned by the Government of Bangladesh.

Professor Muhammad Yunus, recipient of the Nobel Peace Prize for 2006 (Photo: Grameen Bank)

Microfinance is a method to promote the self-help efforts of people by offering small-scale loans and financial services without collateral or guarantors with an aim to help expand borrowers' business activities and increase their income. Japan has been offering assistance to the microfinance sector, recognizing its effectiveness for poverty reduction. For example, Japan has extended a total of US$940,000 in credit resources to 11 non-governmental organizations (NGOs) in Japan and abroad under grant assistance for grassroots human security projects and for Japanese NGO projects. For technical cooperation, since 1997 Japan has been assisting the creation of microfinance systems and the development of the relevant organizations through 29 projects which have been implemented by the Japan International Cooperation Agency (JICA). Japan also extends assistance through international organizations such as the World Bank and the United Nations Development Programme (UNDP).

As part of this assistance, Japan offered yen loans to the Grameen Bank. Not only extending credit to customers, the bank also encourages saving to avoid the easy reliance on borrowing. To this end, the bank organizes groups of five borrowers to consult with each other on repayment and other issues. The bank's unique system also includes weekly visits by its personnel to villages to collect repayment. These models presented by the Grameen Bank have been recognized as effective and thus are being used over an expanded area. Japan assisted the bank's activities by a yen loan in 1995, the very year when the bank was drawing up its fourth plan to expand the scale of its operations.

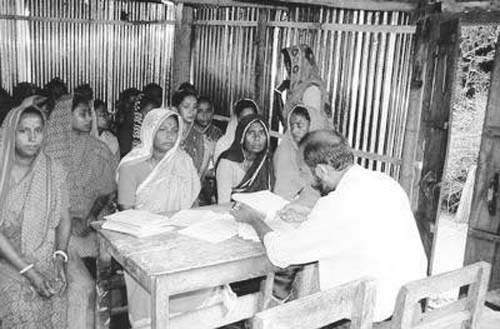

In this year Japan exchanged official documents with the Government of Bangladesh to offer funds totaling ¥2,986 million in the Rural Development Credit Project. Through this commitment, Japan cooperated with the fourth plan of the Grameen Bank, as these funds were used as resources for microfinance, and thus extended to underprivileged people through the bank up until 1998. With initiatives taken by the borrowers, the funds were used to build houses, toilets, and wells, as well as to purchase production equipment. The bank sets ceilings of loans, for example for building houses at 25,000 taka (about US$390).1 Women account for 94% of the bank's clientele, and the money lent by the bank enables women borrowers to buy livestock and pursue other activities, helping them increase their income and thus enhance their status in their families and society. A third-party evaluation concluded that Japan's assistance contributed to improving the living environment of the impoverished and moreover helped these people to run their own businesses, thereby promoting their economic independence.

After this project, the Grameen Bank further expanded its activities to grow into an independent bank that no longer needs assistance from donors. Moreover, the bank's model activities have been spread worldwide and applauded for their contribution to global poverty reduction. All the people of Bangladesh have had their confidence and pride further inspired by the winning of the Nobel Peace Prize by Professor Yunus and Grameen Bank to which Japan once offered assistance.

Women waiting to repay their loans

Next Page

Next Page